During the recent acquisition of Billdesk by PayU for a mind-boggling $4.7 billion, one of the founders of Billdesk opined that payments may be going the telecom way. With wafer thin margins and competition everywhere, maybe that is really the case. One of the early indications of monopolistic markets is consolidation. For the past 18 to 20 months, we have seen a wave of consolidation hitting the payment markets. In this article, I have analyzed some of the major consolidation plays in the recent past, tried to analyze the rationale, and crystal-gaze into the future.

Before we get into the details, let’s take a quick look at some high-level trends we observed:

- M&A deals in 2021 (13 deals) have already outnumbered the deals that took place in 2020 (9 deals), and we still have 3 months left in the year!

- 2020 takes the cake when it comes to the deal size of the acquisitions. The top 3 deals for the period from 2020 to present (except for Billdesk) –

- PayU + PaySense – USD 185 million (Jan 2020)

- Navi + Essel Finance – USD 91 million (Dec 2020)

- Pine Labs + Fave – USD 45million (Apr 2021)

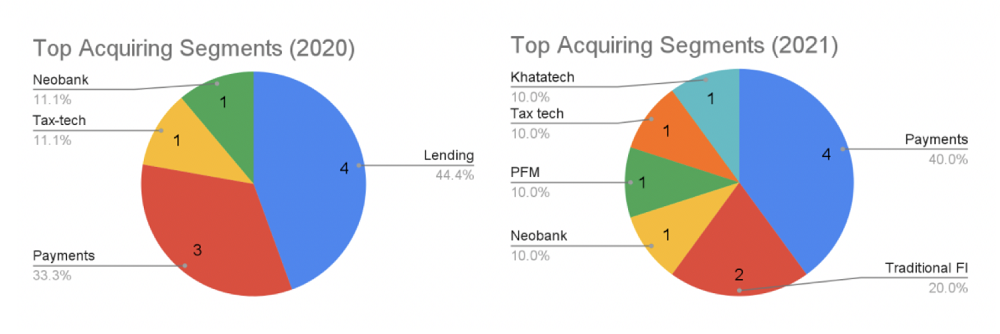

- Companies from the lending and payments segment are the most common acquirers in the deals analysed

Now that we’ve looked at some stats, it’s time for some facts. Let’s take a closer look at some of the most well-known fintech M&As that have occurred in the past two years, shall we?

Now that we’ve looked at some stats, it’s time for some facts. Let’s take a closer look at some of the most well-known fintech M&As that have occurred in the past two years, shall we?

First up are some blockbuster M&As from 2020. COVID-19 who?

PayU acquires PaySense for $185 million!

Imagine entering 2020 with one of the fastest-growing digital lending platforms. While we were slightly afraid of COVID in January 2020, who would’ve imagined within a matter of

two months we’d be hit by words like ‘moratorium’— something that most borrowers would struggle to spell in one go.

Enter PayU, not only acquiring PaySense, but also starting 2020 with India’s largest fintech M&A with respect to the deal size.

This acquisition also made sense considering PayU’s reported plans of merging PaySense and LazyPay (a BNPL company owned and operated by PayU).

PaySense was founded in 2015 and over 5 years, it has done nothing less than build a super robust and smooth data analytics and risk management system for serving credit products to the ‘new to credit’ folks. Over the years,it also attracted funding from marquee VCs like Jungle Ventures, Nexus, and Naspers.

LazyPay, on the other hand, was founded in 2017 with a BNPL product just-in-time, stacking up on a new customer base.

InCred acquires Qbera

Let’s try to remember June 2020, when the lockdown was giving us all new cooking skills, while we got familiar with words like ‘moratorium’ and ‘quarantine.’

If we travel back in timeto quickly check on market sentiments then, nearly all banking and NBFC stocks were struggling to rise from the big fall in March‘20.

All in all, the sector was greying up, starving for capital for a muted growth in anticipation of the pandemic. You can debate that this wasn’t the right time to step into lending, but would this be true?

Wouldn’t this be the time when you’d look for support (not from an expensive source) to make yourself as robust as possible?

Well, that’s what the NBFC, with a loan book of more than Rs. 2000 crores, InCred did! Qbera had mastered the digital distribution line via partnerships with multiple entities like RBL, IndusInd, and Fullerton.

A classic case of leveraging existing customers of the big boy while the smaller entity focuses on building amazing tech. The deal was closed somewhere within the range of $10 to $15 million.

NeobanksLove WealthTech

Imagine going to a supermarket with a small basket and shopping for the ingredients of a cake (all this sounds like a dream now).

Anyway, what you get by mixing all the products is a delicious slice of cake. That’s the kind of shopping spree Indian neobanks have been going on year after year!

In 2020, one of the first millennial-focused neobank in the Indian fintech space Niyo, acquired a digital mutual fund platform Goalwise.

When was the last time you went to a bank to open your account? If you’re having a hard time recollecting, so are the 2 million-plus users of Niyo. Now there are enough and more products that make banks almost unnecessary in our daily lives and the only escape that neobanks have to this problem is including as many gamified products on the wealth management side as possible. The Goalwise team has joined Niyo’s leadership to manage Niyo Money as a separate vertical and offer its users wealth-related products.

2021’s most trending neobank with an uber-smooth onboarding, Jupiter, went down a similar path to acquire EasyPlan!

Navi on the acquiring spree!

What would you do to build a bank with one aim — to make it the next (yet better) HDFC bank?

Deal with slow, boring, hectic, and *add all frustrating adjectives* legal processes?

Nah. Our ex-Flipkart founder has an easier and smarter way out, maybe?

Allow us to tell you a small story. A story of crisis.

A virtual cookie from Afshan to whoever guesses this company

We still remember the day we were attending lectures at BSE itself when DHFL fell down tumbling. We felt the panic. It was bad. We won’t talk a lot about what exactly happened there but let’s say they faced a super bad liquidity crunch.

We still remember the day we were attending lectures at BSE itself when DHFL fell down tumbling. We felt the panic. It was bad. We won’t talk a lot about what exactly happened there but let’s say they faced a super bad liquidity crunch.

Something similar happened with Essel Group in their debt crisis story.

How is this relevant?

Well, Sachin Bansal acquired two companies. No, not startups.

Come January 2020 when Navi raised a whopping $30 million from IFC, just to buy out a few companies here and there. Before the raise, Navi had already acquired one NBFC named Chaitanya India Fin Credit in 2019. Chaitanya back then had applied for an INR 80crores loan book NBFC license. This almost immediately enabled Navi to give loans.

After the fresh fundraiser in January 2020, Sachin Bansal stepped up by acquiring DHFL’s general insurance arm for around INR 100 crores. DHFL GI came in with a 0.09% market share. However low that is, the market opportunity of general insurance in India is HUGE with only 0.93% of penetration in the country. You wouldn’t want to waste this by spending months to get a license approved from IRDAI. Especially if you are someone as influential as Sachin Bansal and have a motto of competing against biggies like Amazon and HDFC Bank.

Navi doesn’t stop here, of course. In April 2020, Navi raised another $27 million to enter the Series C club. Post this, it acquired Essel Mutual Fund in December 2020 for approximately $91 million. Essel MF had almost 0.05% of the market share. Following the acquisition, Navi has widely started offering its mutual fund services via a whole new platform!

Navi is not just making super easy tech-first finance products but also setting up a super strong distribution system by not just buying companies, but buying licenses.

The talks about Navi’s acquisition spree are still trending as it eyes acquiring Liberty General Insurance and Aviva Life Insurance Company (a JV between UK based Aviva and Dabur).

We are still super bullish on Navi becoming a unicorn anytime soon now!